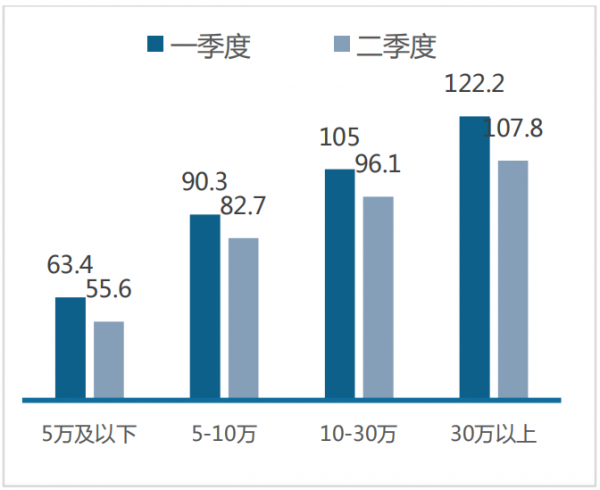

</span></section></section></section></section></section></section><section style="display: inline-block;width: 100%;vertical-align: top;padding: 20px 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="text-align: justify;line-height: 2.5;letter-spacing: 2px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="box-sizing: border-box;">经历了疫情冲击和股市起伏的2020上半年,中国家庭的理财行为有什么变化?</span></p><p style="box-sizing: border-box;">是愿意<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">存钱</strong></span>还是更爱<span style="color:#376fbc;box-sizing: border-box;"><strong style="box-sizing: border-box;">投资</strong></span>?</p><p style="box-sizing: border-box;">是愿意<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">炒股</strong></span>还是更爱<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">买</strong></span><span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">基金</strong></span>?</p><p style="box-sizing: border-box;">大家都打算把钱投向哪儿?</p></section></section></section></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><section style="align-items: center;display: flex;margin: 10px 0%;box-sizing: border-box;"><section style="display: inline-block;vertical-align: bottom;width: auto;flex: 1 0 1px;letter-spacing: 0px;box-sizing: border-box;"><section style="margin-top: 0.5em;margin-bottom: 0.5em;box-sizing: border-box;" powered-by="xiumi.us"><section style="border-top: 1px dashed rgb(62, 62, 62);box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section></section><section style="display: inline-block;vertical-align: bottom;width: auto;flex: 0 1 auto;box-shadow: rgb(0, 0, 0) 0px 0px 0px;line-height: 0;padding-right: 5px;padding-left: 5px;box-sizing: border-box;"><section style="transform: rotateZ(45deg);-webkit-transform: rotateZ(45deg);-moz-transform: rotateZ(45deg);-o-transform: rotateZ(45deg);box-sizing: border-box;" powered-by="xiumi.us"><section style="text-align: center;box-sizing: border-box;"><section style="display: inline-block;width: 10px;height: 10px;vertical-align: top;overflow: hidden;background-color: rgb(255, 222, 23);border-width: 1px;border-radius: 0px;border-style: solid;border-color: rgb(62, 62, 62);box-shadow: rgb(255, 255, 255) 1px 1px 0px inset;line-height: 0;letter-spacing: 0px;box-sizing: border-box;"><section style="text-align: justify;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section></section></section></section></section><section style="display: inline-block;vertical-align: bottom;width: auto;flex: 1 0 1px;box-sizing: border-box;"><section style="margin-top: 0.5em;margin-bottom: 0.5em;box-sizing: border-box;" powered-by="xiumi.us"><section style="border-top: 1px dashed rgb(62, 62, 62);box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section></section></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">日前,西南财经大学中国家庭金融调查与研究中心联合蚂蚁集团研究院,共同发布了2020年第二季度<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">中国家庭财富指数报告</strong></span>(以下简称报告)。报告显示,疫情期间,中国人在线理财需求大增,存钱意愿降低,更愿意拿钱去买基金而非炒股。2020年新增“基民”中,30岁以下的90后占到了一半以上。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="margin-top: 10px;margin-right: 0%;margin-left: 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;width: 100%;vertical-align: top;border-width: 1px;border-radius: 0px;border-style: solid solid none;border-color: rgb(188, 188, 188) rgb(188, 188, 188) rgb(62, 62, 62);box-sizing: border-box;"><section style="text-align: right;font-size: 0px;margin: -2px 0% -10px;justify-content: flex-end;transform: translate3d(-40px, 0px, 0px);-webkit-transform: translate3d(-40px, 0px, 0px);-moz-transform: translate3d(-40px, 0px, 0px);-o-transform: translate3d(-40px, 0px, 0px);box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block; width: 40px; height: 10px; vertical-align: top; overflow: hidden; box-shadow: rgb(0, 0, 0) 0px 0px 0px; box-sizing: border-box;"><section style="text-align: center;margin-top: -1px;margin-right: 0%;margin-left: 0%;justify-content: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;width: 53%;height: 100px;vertical-align: top;overflow: hidden;background-color: rgb(188, 188, 188);box-shadow: rgb(0, 0, 0) 0px 0px 0px;box-sizing: border-box;line-height: 0;"><br></section></section></section></section><section style="margin: 5px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;padding-right: 15px;padding-left: 15px;line-height: 2;color: rgb(95, 156, 239);box-sizing: border-box;"><p style="box-sizing: border-box;"><span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">中国家庭财富指数</strong></span><strong style="box-sizing: border-box;"></strong></p></section></section></section></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><section style="display: flex;flex-flow: row nowrap;margin-right: 0%;margin-bottom: 10px;margin-left: 0%;box-sizing: border-box;"><section style="display: inline-block;width: 13px;box-shadow: rgb(255, 255, 255) -3px 3px 0px inset;border-top: 1px solid rgb(188, 188, 188);border-top-left-radius: 0px;border-right: 1px none rgb(62, 62, 62);border-top-right-radius: 0px;background-color: rgb(95, 156, 239);flex: 0 0 auto;height: auto;vertical-align: top;align-self: stretch;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;width: auto;border-left: 1px solid rgb(188, 188, 188);border-bottom-left-radius: 0px;box-shadow: rgb(255, 255, 255) 0px 0px 0px;border-right: 1px solid rgb(188, 188, 188);border-top-right-radius: 0px;flex: 100 100 0%;align-self: stretch;height: auto;border-bottom: 1px solid rgb(188, 188, 188);border-bottom-right-radius: 0px;padding-right: 16px;padding-bottom: 10px;padding-left: 16px;box-sizing: border-box;"><section style="margin-right: 0%;margin-bottom: 12px;margin-left: 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="background-color: rgb(188, 188, 188);height: 1px;box-sizing: border-box;line-height: 0;"><br></section></section><section style="color: rgb(79, 79, 79);line-height: 2.5;letter-spacing: 2px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">中国家庭财富指数<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">以100为基准线</strong></span>,通过大范围调研计算指数变化,以此跟踪观察中国家庭理财行为和观念的变化。根据家庭的财富变化情况构造指数,指数取值范围在0-200之间。大于100表示(相比上季度)增加(上涨),小于100表示(相比上季度)减少(下降)。</p></section></section></section></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="margin-top: 0.5em;margin-bottom: 0.5em;text-align: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;vertical-align: top;width: 0px;margin-top: 0.4em;border-left: 0.8em solid rgb(95, 156, 239);border-top: 0.8em solid rgb(95, 156, 239);border-right: 0.8em solid transparent !important;border-bottom: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;max-width: 80% !important;box-sizing: border-box;"><section style="margin: 10px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;line-height: 1.8;box-sizing: border-box;"><p style="box-sizing: border-box;"><span style="font-size: 17px;box-sizing: border-box;"><strong style="box-sizing: border-box;">资产配置逐渐趋于均衡</strong></span><br style="box-sizing: border-box;"></p></section></section></section><section style="display: inline-block;vertical-align: bottom;width: 0px;margin-bottom: 0.3em;border-right: 0.8em solid rgb(95, 156, 239);border-bottom: 0.8em solid rgb(95, 156, 239);border-left: 0.8em solid transparent !important;border-top: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">报告显示,二季度家庭财富指数为 99.92,与上季度家庭财富基本持平。其中,部分家庭财富缩水较为严重,如低收入及自由职业家庭。一季度收入5万元及以下家庭的财富指数为63.4,二季度继续下降,仅为55.6,意味着低收入家庭财富继续缩水。自由职业者的家庭财富指数从一季度的78.2下降到二季度的69.2,财富缩水也较为严重。<br style="box-sizing: border-box;"></p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;">

</span></section></section></section></section></section></section><section style="display: inline-block;width: 100%;vertical-align: top;padding: 20px 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="text-align: justify;line-height: 2.5;letter-spacing: 2px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="box-sizing: border-box;">经历了疫情冲击和股市起伏的2020上半年,中国家庭的理财行为有什么变化?</span></p><p style="box-sizing: border-box;">是愿意<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">存钱</strong></span>还是更爱<span style="color:#376fbc;box-sizing: border-box;"><strong style="box-sizing: border-box;">投资</strong></span>?</p><p style="box-sizing: border-box;">是愿意<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">炒股</strong></span>还是更爱<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">买</strong></span><span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">基金</strong></span>?</p><p style="box-sizing: border-box;">大家都打算把钱投向哪儿?</p></section></section></section></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><section style="align-items: center;display: flex;margin: 10px 0%;box-sizing: border-box;"><section style="display: inline-block;vertical-align: bottom;width: auto;flex: 1 0 1px;letter-spacing: 0px;box-sizing: border-box;"><section style="margin-top: 0.5em;margin-bottom: 0.5em;box-sizing: border-box;" powered-by="xiumi.us"><section style="border-top: 1px dashed rgb(62, 62, 62);box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section></section><section style="display: inline-block;vertical-align: bottom;width: auto;flex: 0 1 auto;box-shadow: rgb(0, 0, 0) 0px 0px 0px;line-height: 0;padding-right: 5px;padding-left: 5px;box-sizing: border-box;"><section style="transform: rotateZ(45deg);-webkit-transform: rotateZ(45deg);-moz-transform: rotateZ(45deg);-o-transform: rotateZ(45deg);box-sizing: border-box;" powered-by="xiumi.us"><section style="text-align: center;box-sizing: border-box;"><section style="display: inline-block;width: 10px;height: 10px;vertical-align: top;overflow: hidden;background-color: rgb(255, 222, 23);border-width: 1px;border-radius: 0px;border-style: solid;border-color: rgb(62, 62, 62);box-shadow: rgb(255, 255, 255) 1px 1px 0px inset;line-height: 0;letter-spacing: 0px;box-sizing: border-box;"><section style="text-align: justify;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section></section></section></section></section><section style="display: inline-block;vertical-align: bottom;width: auto;flex: 1 0 1px;box-sizing: border-box;"><section style="margin-top: 0.5em;margin-bottom: 0.5em;box-sizing: border-box;" powered-by="xiumi.us"><section style="border-top: 1px dashed rgb(62, 62, 62);box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section></section></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">日前,西南财经大学中国家庭金融调查与研究中心联合蚂蚁集团研究院,共同发布了2020年第二季度<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">中国家庭财富指数报告</strong></span>(以下简称报告)。报告显示,疫情期间,中国人在线理财需求大增,存钱意愿降低,更愿意拿钱去买基金而非炒股。2020年新增“基民”中,30岁以下的90后占到了一半以上。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="margin-top: 10px;margin-right: 0%;margin-left: 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;width: 100%;vertical-align: top;border-width: 1px;border-radius: 0px;border-style: solid solid none;border-color: rgb(188, 188, 188) rgb(188, 188, 188) rgb(62, 62, 62);box-sizing: border-box;"><section style="text-align: right;font-size: 0px;margin: -2px 0% -10px;justify-content: flex-end;transform: translate3d(-40px, 0px, 0px);-webkit-transform: translate3d(-40px, 0px, 0px);-moz-transform: translate3d(-40px, 0px, 0px);-o-transform: translate3d(-40px, 0px, 0px);box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block; width: 40px; height: 10px; vertical-align: top; overflow: hidden; box-shadow: rgb(0, 0, 0) 0px 0px 0px; box-sizing: border-box;"><section style="text-align: center;margin-top: -1px;margin-right: 0%;margin-left: 0%;justify-content: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;width: 53%;height: 100px;vertical-align: top;overflow: hidden;background-color: rgb(188, 188, 188);box-shadow: rgb(0, 0, 0) 0px 0px 0px;box-sizing: border-box;line-height: 0;"><br></section></section></section></section><section style="margin: 5px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;padding-right: 15px;padding-left: 15px;line-height: 2;color: rgb(95, 156, 239);box-sizing: border-box;"><p style="box-sizing: border-box;"><span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">中国家庭财富指数</strong></span><strong style="box-sizing: border-box;"></strong></p></section></section></section></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><section style="display: flex;flex-flow: row nowrap;margin-right: 0%;margin-bottom: 10px;margin-left: 0%;box-sizing: border-box;"><section style="display: inline-block;width: 13px;box-shadow: rgb(255, 255, 255) -3px 3px 0px inset;border-top: 1px solid rgb(188, 188, 188);border-top-left-radius: 0px;border-right: 1px none rgb(62, 62, 62);border-top-right-radius: 0px;background-color: rgb(95, 156, 239);flex: 0 0 auto;height: auto;vertical-align: top;align-self: stretch;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;width: auto;border-left: 1px solid rgb(188, 188, 188);border-bottom-left-radius: 0px;box-shadow: rgb(255, 255, 255) 0px 0px 0px;border-right: 1px solid rgb(188, 188, 188);border-top-right-radius: 0px;flex: 100 100 0%;align-self: stretch;height: auto;border-bottom: 1px solid rgb(188, 188, 188);border-bottom-right-radius: 0px;padding-right: 16px;padding-bottom: 10px;padding-left: 16px;box-sizing: border-box;"><section style="margin-right: 0%;margin-bottom: 12px;margin-left: 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="background-color: rgb(188, 188, 188);height: 1px;box-sizing: border-box;line-height: 0;"><br></section></section><section style="color: rgb(79, 79, 79);line-height: 2.5;letter-spacing: 2px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">中国家庭财富指数<span style="color: rgb(55, 111, 188);box-sizing: border-box;"><strong style="box-sizing: border-box;">以100为基准线</strong></span>,通过大范围调研计算指数变化,以此跟踪观察中国家庭理财行为和观念的变化。根据家庭的财富变化情况构造指数,指数取值范围在0-200之间。大于100表示(相比上季度)增加(上涨),小于100表示(相比上季度)减少(下降)。</p></section></section></section></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="margin-top: 0.5em;margin-bottom: 0.5em;text-align: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;vertical-align: top;width: 0px;margin-top: 0.4em;border-left: 0.8em solid rgb(95, 156, 239);border-top: 0.8em solid rgb(95, 156, 239);border-right: 0.8em solid transparent !important;border-bottom: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;max-width: 80% !important;box-sizing: border-box;"><section style="margin: 10px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;line-height: 1.8;box-sizing: border-box;"><p style="box-sizing: border-box;"><span style="font-size: 17px;box-sizing: border-box;"><strong style="box-sizing: border-box;">资产配置逐渐趋于均衡</strong></span><br style="box-sizing: border-box;"></p></section></section></section><section style="display: inline-block;vertical-align: bottom;width: 0px;margin-bottom: 0.3em;border-right: 0.8em solid rgb(95, 156, 239);border-bottom: 0.8em solid rgb(95, 156, 239);border-left: 0.8em solid transparent !important;border-top: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">报告显示,二季度家庭财富指数为 99.92,与上季度家庭财富基本持平。其中,部分家庭财富缩水较为严重,如低收入及自由职业家庭。一季度收入5万元及以下家庭的财富指数为63.4,二季度继续下降,仅为55.6,意味着低收入家庭财富继续缩水。自由职业者的家庭财富指数从一季度的78.2下降到二季度的69.2,财富缩水也较为严重。<br style="box-sizing: border-box;"></p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;"> </span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">家庭财富指数(按税前年收入分组)</span><br style="box-sizing: border-box;"></p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;">

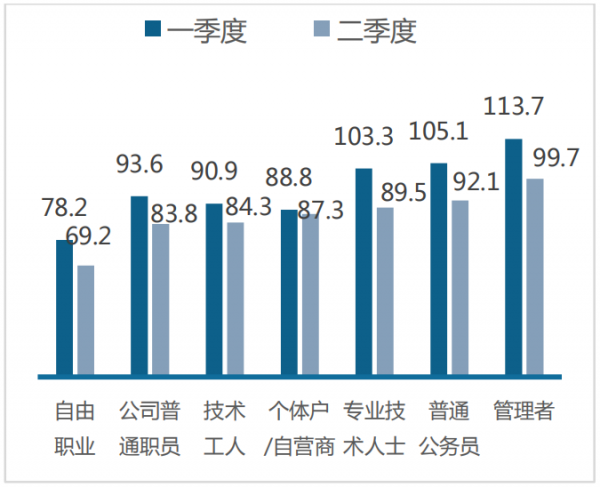

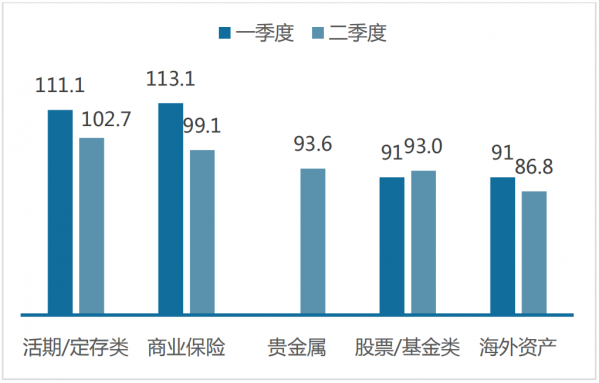

</span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">家庭财富指数(按税前年收入分组)</span><br style="box-sizing: border-box;"></p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;"> </span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="font-size: 14px;color: rgb(160, 160, 160);box-sizing: border-box;">家庭财富指数(按职业分组)</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">相比上季度,二季度家庭资产配置趋于均衡。通过询问家庭未来3个月对资产的调整选择(增加很多、增加一点、基本不变、减少一点和减少很多)构造指数,可见相比上季度,二季度家庭资产配置趋于均衡。表现在家庭对活期、定存类及商业保险类等低风险类资产的配置需求增速减缓,家庭继续减持海外资产,对股票基金类资产需求略有回温,降幅收窄。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;">

</span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="font-size: 14px;color: rgb(160, 160, 160);box-sizing: border-box;">家庭财富指数(按职业分组)</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">相比上季度,二季度家庭资产配置趋于均衡。通过询问家庭未来3个月对资产的调整选择(增加很多、增加一点、基本不变、减少一点和减少很多)构造指数,可见相比上季度,二季度家庭资产配置趋于均衡。表现在家庭对活期、定存类及商业保险类等低风险类资产的配置需求增速减缓,家庭继续减持海外资产,对股票基金类资产需求略有回温,降幅收窄。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;"> </span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">各类资产配置意愿指数</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br></p></section><section style="margin-top: 0.5em;margin-bottom: 0.5em;text-align: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;vertical-align: top;width: 0px;margin-top: 0.4em;border-left: 0.8em solid rgb(95, 156, 239);border-top: 0.8em solid rgb(95, 156, 239);border-right: 0.8em solid transparent !important;border-bottom: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;max-width: 80% !important;box-sizing: border-box;"><section style="margin: 10px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;line-height: 1.8;box-sizing: border-box;"><p style="box-sizing: border-box;"><strong style="box-sizing: border-box;"><span style="font-size: 17px;box-sizing: border-box;">更愿买基金而非炒股</span></strong><br style="box-sizing: border-box;"></p></section></section></section><section style="display: inline-block;vertical-align: bottom;width: 0px;margin-bottom: 0.3em;border-right: 0.8em solid rgb(95, 156, 239);border-bottom: 0.8em solid rgb(95, 156, 239);border-left: 0.8em solid transparent !important;border-top: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">Wind数据显示,截至2019年中期,中国家庭财富总值从2000年的3.7万亿美元增长至63.8万亿美元,全球占比达18%,排名世界第二,仅次于美国。也就是说,算下来相当于2000年中国人均财富约2800美元,而2019年大幅增至约4.5万美元。报告显示,自一季度以来,中国家庭线上投资意愿指数平均为109.6,线上投资的意愿明显增加。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;">

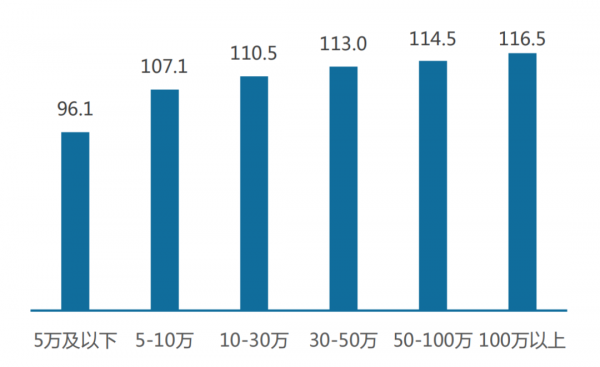

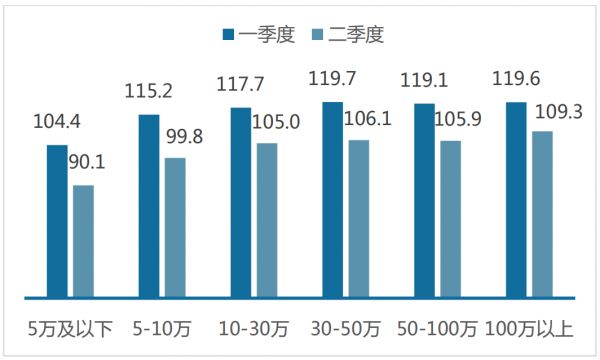

</span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">各类资产配置意愿指数</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br></p></section><section style="margin-top: 0.5em;margin-bottom: 0.5em;text-align: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;vertical-align: top;width: 0px;margin-top: 0.4em;border-left: 0.8em solid rgb(95, 156, 239);border-top: 0.8em solid rgb(95, 156, 239);border-right: 0.8em solid transparent !important;border-bottom: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;max-width: 80% !important;box-sizing: border-box;"><section style="margin: 10px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;line-height: 1.8;box-sizing: border-box;"><p style="box-sizing: border-box;"><strong style="box-sizing: border-box;"><span style="font-size: 17px;box-sizing: border-box;">更愿买基金而非炒股</span></strong><br style="box-sizing: border-box;"></p></section></section></section><section style="display: inline-block;vertical-align: bottom;width: 0px;margin-bottom: 0.3em;border-right: 0.8em solid rgb(95, 156, 239);border-bottom: 0.8em solid rgb(95, 156, 239);border-left: 0.8em solid transparent !important;border-top: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">Wind数据显示,截至2019年中期,中国家庭财富总值从2000年的3.7万亿美元增长至63.8万亿美元,全球占比达18%,排名世界第二,仅次于美国。也就是说,算下来相当于2000年中国人均财富约2800美元,而2019年大幅增至约4.5万美元。报告显示,自一季度以来,中国家庭线上投资意愿指数平均为109.6,线上投资的意愿明显增加。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;"> </span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">线上投资意愿指数(按金融资产分组)</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br></p><p style="box-sizing: border-box;">理财需求旺盛之下,大家都打算把钱投向哪儿?上海新金融研究院理事长屠光绍认为,中国家庭财富结构出现从储蓄到理财、从房产到金融资产的趋势。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">报告也显示了类似的观点。中国家庭的存款意愿指数从一季度的111.1降到了二季度的102.7。中国一直是储蓄大国,这个数据的变化说明,越来越多的中国家庭不再将储蓄作为财富管理的唯一选择。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">今年市场行情大涨,大众对于股票和基金的热情也格外高涨。有意思的是,中国家庭更倾向于买基金而非炒股。二季度中国家庭的股票配置意愿只有90,基金则有96。如果是金融资产在10万元以上的家庭,则股票配置意愿为97.16,基金为103.91。报告还显示,中国家庭更倾向于中长期持有基金。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;">

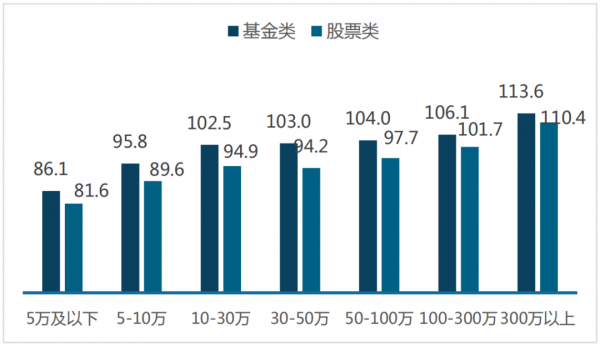

</span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">线上投资意愿指数(按金融资产分组)</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br></p><p style="box-sizing: border-box;">理财需求旺盛之下,大家都打算把钱投向哪儿?上海新金融研究院理事长屠光绍认为,中国家庭财富结构出现从储蓄到理财、从房产到金融资产的趋势。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">报告也显示了类似的观点。中国家庭的存款意愿指数从一季度的111.1降到了二季度的102.7。中国一直是储蓄大国,这个数据的变化说明,越来越多的中国家庭不再将储蓄作为财富管理的唯一选择。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">今年市场行情大涨,大众对于股票和基金的热情也格外高涨。有意思的是,中国家庭更倾向于买基金而非炒股。二季度中国家庭的股票配置意愿只有90,基金则有96。如果是金融资产在10万元以上的家庭,则股票配置意愿为97.16,基金为103.91。报告还显示,中国家庭更倾向于中长期持有基金。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;"> </span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">股票/基金类资产配置意愿指数(按金融资产分组)</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br></p><p style="box-sizing: border-box;">股票和基金市场规模的变化也印证了上述趋势。宏观数据显示,今年年初,境内上市公司流通市值增速下降,公募基金规模增长迅速。对比公募基金及股票市值的规模变化,自2019年9月份,公募基金规模持续增长,到年初也持续了增长趋势,而境内上市公司流通市值增速下滑。从公募基金市值与股票市值的比值来看,1月份以来也一直呈上升趋势。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">另外,2020年新增“基民”中,30岁以下的年轻人占到了一半以上,年轻化趋势明显,他们也更愿意追投基金。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="margin-top: 0.5em;margin-bottom: 0.5em;text-align: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;vertical-align: top;width: 0px;margin-top: 0.4em;border-left: 0.8em solid rgb(95, 156, 239);border-top: 0.8em solid rgb(95, 156, 239);border-right: 0.8em solid transparent !important;border-bottom: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;max-width: 80% !important;box-sizing: border-box;"><section style="margin: 10px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;line-height: 1.8;box-sizing: border-box;"><p style="box-sizing: border-box;"><span style="font-size: 17px;box-sizing: border-box;"><strong style="box-sizing: border-box;">大众理财更趋于理性</strong></span><br style="box-sizing: border-box;"></p></section></section></section><section style="display: inline-block;vertical-align: bottom;width: 0px;margin-bottom: 0.3em;border-right: 0.8em solid rgb(95, 156, 239);border-bottom: 0.8em solid rgb(95, 156, 239);border-left: 0.8em solid transparent !important;border-top: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">报告分析发现,经济恢复预期对家庭的资产配置行为无影响,即不是预期驱动导致的家庭理财偏向基金类资产。同时,家庭增投基金的行为也不是资产驱动,资产增加或减少,家庭都倾向于投资基金。此外,也不是收入驱动,收入变动与基金投资没有同增同减。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">“愿意选择基金而非股票,说明众多个人投资者越来越理性了。”蚂蚁集团数字金融财富事业群总经理王珺表示,无论从经济结构还是疫情影响来看,当下权益类市场的结构性行情都较为明显。普通用户可能不知道怎么选行业并判断市场走势,而基金管理人则可以发挥专业能力,帮助大家参与到这轮行情。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">西南财经大学中国家庭金融调查与研究中心主任甘犁表示:“疫情加速了我国线上投资理财需求,也让中国家庭的理财观念变得更理性,相比股市,投资基金的人正在增多,这也是国家所鼓励的,让个人投资者通过基金去参与股市。”</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="margin-top: 0.5em;margin-bottom: 0.5em;text-align: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;vertical-align: top;width: 0px;margin-top: 0.4em;border-left: 0.8em solid rgb(95, 156, 239);border-top: 0.8em solid rgb(95, 156, 239);border-right: 0.8em solid transparent !important;border-bottom: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;max-width: 80% !important;box-sizing: border-box;"><section style="margin: 10px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;line-height: 1.8;box-sizing: border-box;"><p style="box-sizing: border-box;"><span style="font-size: 17px;box-sizing: border-box;"><strong style="box-sizing: border-box;">保险配置和购房意愿上升</strong></span><br style="box-sizing: border-box;"></p></section></section></section><section style="display: inline-block;vertical-align: bottom;width: 0px;margin-bottom: 0.3em;border-right: 0.8em solid rgb(95, 156, 239);border-bottom: 0.8em solid rgb(95, 156, 239);border-left: 0.8em solid transparent !important;border-top: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">近些年来,家庭购买商业保险的意识不断提高。根据CHFS数据,2019年有10.8%的居民持有商业保险,2011年这一数字仅为5.2%。研究显示,在给家庭成员参保的过程中存在一个误区,即对家庭经济支柱者的参保度不够,而偏重青少儿参保。这一现象也在有所缓解,从近些年各年龄段的商业保险参保情况看,家庭经济支柱者参保与家庭青少儿参保的差距在缩小。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">报告显示,在疫情影响下,家庭增加保险类资产配置的意愿提升。一季度各金融资产水平下家庭的商业保险配置意愿均较高,本季度家庭依旧倾向在未来3个月增加商业保险的配置,但低收入家庭的商业保险配置会略微下降。这说明疫情之初,家庭的保险配置意愿较为强烈,到二、三季度,尽管家庭预期经济恢复尚需一段时间,但商业保险配置意愿略有降温。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;">

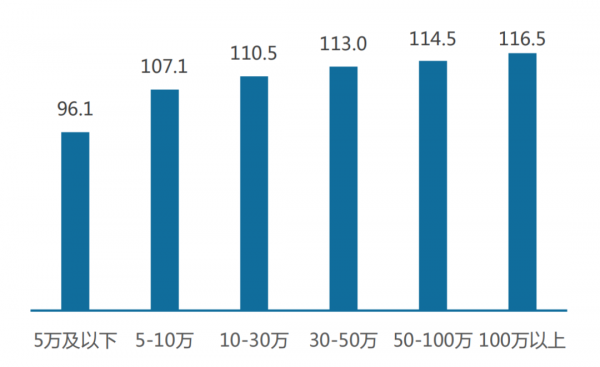

</span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">股票/基金类资产配置意愿指数(按金融资产分组)</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br></p><p style="box-sizing: border-box;">股票和基金市场规模的变化也印证了上述趋势。宏观数据显示,今年年初,境内上市公司流通市值增速下降,公募基金规模增长迅速。对比公募基金及股票市值的规模变化,自2019年9月份,公募基金规模持续增长,到年初也持续了增长趋势,而境内上市公司流通市值增速下滑。从公募基金市值与股票市值的比值来看,1月份以来也一直呈上升趋势。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">另外,2020年新增“基民”中,30岁以下的年轻人占到了一半以上,年轻化趋势明显,他们也更愿意追投基金。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="margin-top: 0.5em;margin-bottom: 0.5em;text-align: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;vertical-align: top;width: 0px;margin-top: 0.4em;border-left: 0.8em solid rgb(95, 156, 239);border-top: 0.8em solid rgb(95, 156, 239);border-right: 0.8em solid transparent !important;border-bottom: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;max-width: 80% !important;box-sizing: border-box;"><section style="margin: 10px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;line-height: 1.8;box-sizing: border-box;"><p style="box-sizing: border-box;"><span style="font-size: 17px;box-sizing: border-box;"><strong style="box-sizing: border-box;">大众理财更趋于理性</strong></span><br style="box-sizing: border-box;"></p></section></section></section><section style="display: inline-block;vertical-align: bottom;width: 0px;margin-bottom: 0.3em;border-right: 0.8em solid rgb(95, 156, 239);border-bottom: 0.8em solid rgb(95, 156, 239);border-left: 0.8em solid transparent !important;border-top: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">报告分析发现,经济恢复预期对家庭的资产配置行为无影响,即不是预期驱动导致的家庭理财偏向基金类资产。同时,家庭增投基金的行为也不是资产驱动,资产增加或减少,家庭都倾向于投资基金。此外,也不是收入驱动,收入变动与基金投资没有同增同减。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">“愿意选择基金而非股票,说明众多个人投资者越来越理性了。”蚂蚁集团数字金融财富事业群总经理王珺表示,无论从经济结构还是疫情影响来看,当下权益类市场的结构性行情都较为明显。普通用户可能不知道怎么选行业并判断市场走势,而基金管理人则可以发挥专业能力,帮助大家参与到这轮行情。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">西南财经大学中国家庭金融调查与研究中心主任甘犁表示:“疫情加速了我国线上投资理财需求,也让中国家庭的理财观念变得更理性,相比股市,投资基金的人正在增多,这也是国家所鼓励的,让个人投资者通过基金去参与股市。”</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="margin-top: 0.5em;margin-bottom: 0.5em;text-align: center;box-sizing: border-box;" powered-by="xiumi.us"><section style="display: inline-block;vertical-align: top;width: 0px;margin-top: 0.4em;border-left: 0.8em solid rgb(95, 156, 239);border-top: 0.8em solid rgb(95, 156, 239);border-right: 0.8em solid transparent !important;border-bottom: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section><section style="display: inline-block;vertical-align: top;max-width: 80% !important;box-sizing: border-box;"><section style="margin: 10px 0%;box-sizing: border-box;" powered-by="xiumi.us"><section style="letter-spacing: 2px;line-height: 1.8;box-sizing: border-box;"><p style="box-sizing: border-box;"><span style="font-size: 17px;box-sizing: border-box;"><strong style="box-sizing: border-box;">保险配置和购房意愿上升</strong></span><br style="box-sizing: border-box;"></p></section></section></section><section style="display: inline-block;vertical-align: bottom;width: 0px;margin-bottom: 0.3em;border-right: 0.8em solid rgb(95, 156, 239);border-bottom: 0.8em solid rgb(95, 156, 239);border-left: 0.8em solid transparent !important;border-top: 0.8em solid transparent !important;box-sizing: border-box;line-height: 0;"><section style="line-height: 0;width: 0px;"><svg viewBox="0 0 1 1" style="vertical-align:top;"></svg></section></section></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;">近些年来,家庭购买商业保险的意识不断提高。根据CHFS数据,2019年有10.8%的居民持有商业保险,2011年这一数字仅为5.2%。研究显示,在给家庭成员参保的过程中存在一个误区,即对家庭经济支柱者的参保度不够,而偏重青少儿参保。这一现象也在有所缓解,从近些年各年龄段的商业保险参保情况看,家庭经济支柱者参保与家庭青少儿参保的差距在缩小。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">报告显示,在疫情影响下,家庭增加保险类资产配置的意愿提升。一季度各金融资产水平下家庭的商业保险配置意愿均较高,本季度家庭依旧倾向在未来3个月增加商业保险的配置,但低收入家庭的商业保险配置会略微下降。这说明疫情之初,家庭的保险配置意愿较为强烈,到二、三季度,尽管家庭预期经济恢复尚需一段时间,但商业保险配置意愿略有降温。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;"> </span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">商业保险购买意愿指数(按金融资产分组)</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">其中,金融资产减少、收入减少的家庭都更倾向于配置保险。报告通过计量分析方法研究影响家庭商业保险投资意愿的影响因素后发现,相比定存类资产,金融资产减少或收入减少的家庭更倾向于配置商业保险,侧面表明当家庭收入没有保障的时候,家庭认可商业保险对自身保障的重要性。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">另外,报告数据还显示,未来3个月,多套房家庭购房意愿更高。一季度多套房家庭的住房投资意愿高达105.2,显著高于其他群体,二季度这一现象持续。从不同房屋持有状况的家庭来看,二季度约二成家庭对购房持观望态度,但多套房家庭计划购房的比例达到12.0%,高于其他家庭。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;">

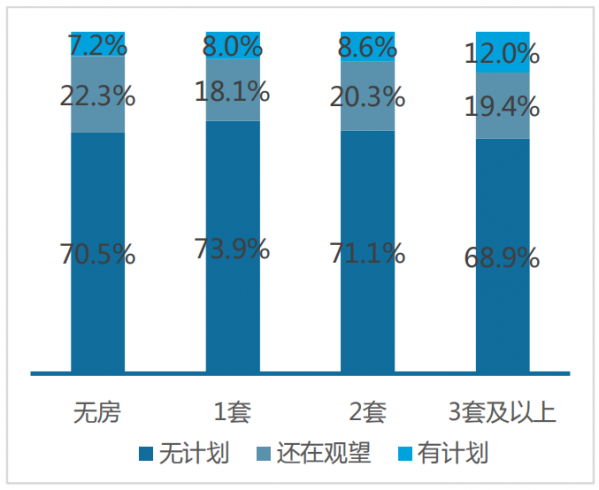

</span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">商业保险购买意愿指数(按金融资产分组)</span><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">其中,金融资产减少、收入减少的家庭都更倾向于配置保险。报告通过计量分析方法研究影响家庭商业保险投资意愿的影响因素后发现,相比定存类资产,金融资产减少或收入减少的家庭更倾向于配置商业保险,侧面表明当家庭收入没有保障的时候,家庭认可商业保险对自身保障的重要性。</p><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;">另外,报告数据还显示,未来3个月,多套房家庭购房意愿更高。一季度多套房家庭的住房投资意愿高达105.2,显著高于其他群体,二季度这一现象持续。从不同房屋持有状况的家庭来看,二季度约二成家庭对购房持观望态度,但多套房家庭计划购房的比例达到12.0%,高于其他家庭。</p></section><section style="text-align: center;margin-top: 10px;margin-bottom: 10px;box-sizing: border-box;" powered-by="xiumi.us"><section style="max-width: 100%;vertical-align: middle;display: inline-block;line-height: 0;box-sizing: border-box;"><span class="wxart_image" wx-style="display:inline-block;vertical-align: middle;box-sizing: border-box;"> </span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">购房计划分布 (按住房情况分组)</span><br style="box-sizing: border-box;"></p></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">文中图表来自报告</span></p></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="text-align: right; box-sizing: border-box;">记者 李林鸾</p><p style="text-align: right; box-sizing: border-box;">编辑 韩业清</p></section></section>转载声明:本文转载自「中国银行保险报」,搜索「cbin-news」即可关注,[<a target="_blank" href="https://mp.weixin.qq.com/s/bzns8JDi6pFNt_JXzTiJVA">阅读原文</a>]。</div><p></p>

</span></section></section><section style="line-height: 2.5;letter-spacing: 2px;padding-right: 8px;padding-left: 8px;box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">购房计划分布 (按住房情况分组)</span><br style="box-sizing: border-box;"></p></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="box-sizing: border-box;"><span style="color: rgb(160, 160, 160);font-size: 14px;box-sizing: border-box;">文中图表来自报告</span></p></section><section style="box-sizing: border-box;" powered-by="xiumi.us"><p style="box-sizing: border-box;"><br style="box-sizing: border-box;"></p><p style="text-align: right; box-sizing: border-box;">记者 李林鸾</p><p style="text-align: right; box-sizing: border-box;">编辑 韩业清</p></section></section>转载声明:本文转载自「中国银行保险报」,搜索「cbin-news」即可关注,[<a target="_blank" href="https://mp.weixin.qq.com/s/bzns8JDi6pFNt_JXzTiJVA">阅读原文</a>]。</div><p></p>

扫一扫,关注我们

1、不得发表违反国家法律法规的内容。用户不得发布负面言论。不得发布与本网站主题无关的内容。如有违反,将采取删除、屏蔽等处理措施,直至向国家相关部门进行举报。

2、网站内容仅为学习笔记、摘录、信息整理,注明来源的版权归原作者所有。如有不妥,请联系删除。信息都不保证其准确性、有效性、时间性。

3、本站不会销售保单,请注意防范风险。

4、根据相关部门的最新要求,所有发帖及评论均须实名制,请实名认证后发言。